Want to boost your accounting career?

An accounts payable certification proves you know how to manage vendor payments, invoices, and financial records like a pro. This credential shows employers you have the skills they need.

Finance professionals choose certification to stand out in competitive job markets.

Accounts payable training builds expertise in payment processing, compliance, and vendor management. Plus, certified professionals often earn higher salaries and land better positions.

Ready to validate your skills and advance your career?

Why Get Certified in Accounts Payable?

Certification gives you a competitive edge in today’s job market. Employers prefer candidates who can prove their skills through recognized credentials.

Certified professionals typically earn 15-25% more than their non-certified peers and get promoted faster.

The credential also validates your expertise in critical areas like fraud prevention, compliance, and process improvement.

Training keeps you current with industry best practices and new technologies. Plus, many companies require certification for senior AP positions, making it essential for career advancement.

Types of Accounts Payable Certifications

Different certifications target different career levels and specializations. Here are the main options available to accounts payable professionals.

- Certified Accounts Payable Professional (CAPP) – Entry-level certification covering basic AP processes and procedures.

- Accounts Payable Specialist (APS) – Mid-level credential focusing on detailed invoice processing and vendor relations.

- Accounts Payable Manager (APM) – Advanced certification for supervisory roles and team leadership skills.

- Certified Treasury Professional (CTP) – Comprehensive credential including AP within broader treasury management.

- Certified Public Bookkeeper (CPB) – General bookkeeping certification that includes accounts payable modules.

- QuickBooks ProAdvisor Certification – Software-specific training for popular accounting platforms.

- Certified Management Accountant (CMA) – High-level certification covering AP as part of management accounting.

Each certification level builds on the previous one, from basic processing skills to strategic financial management. Choose based on your current role and career goals.

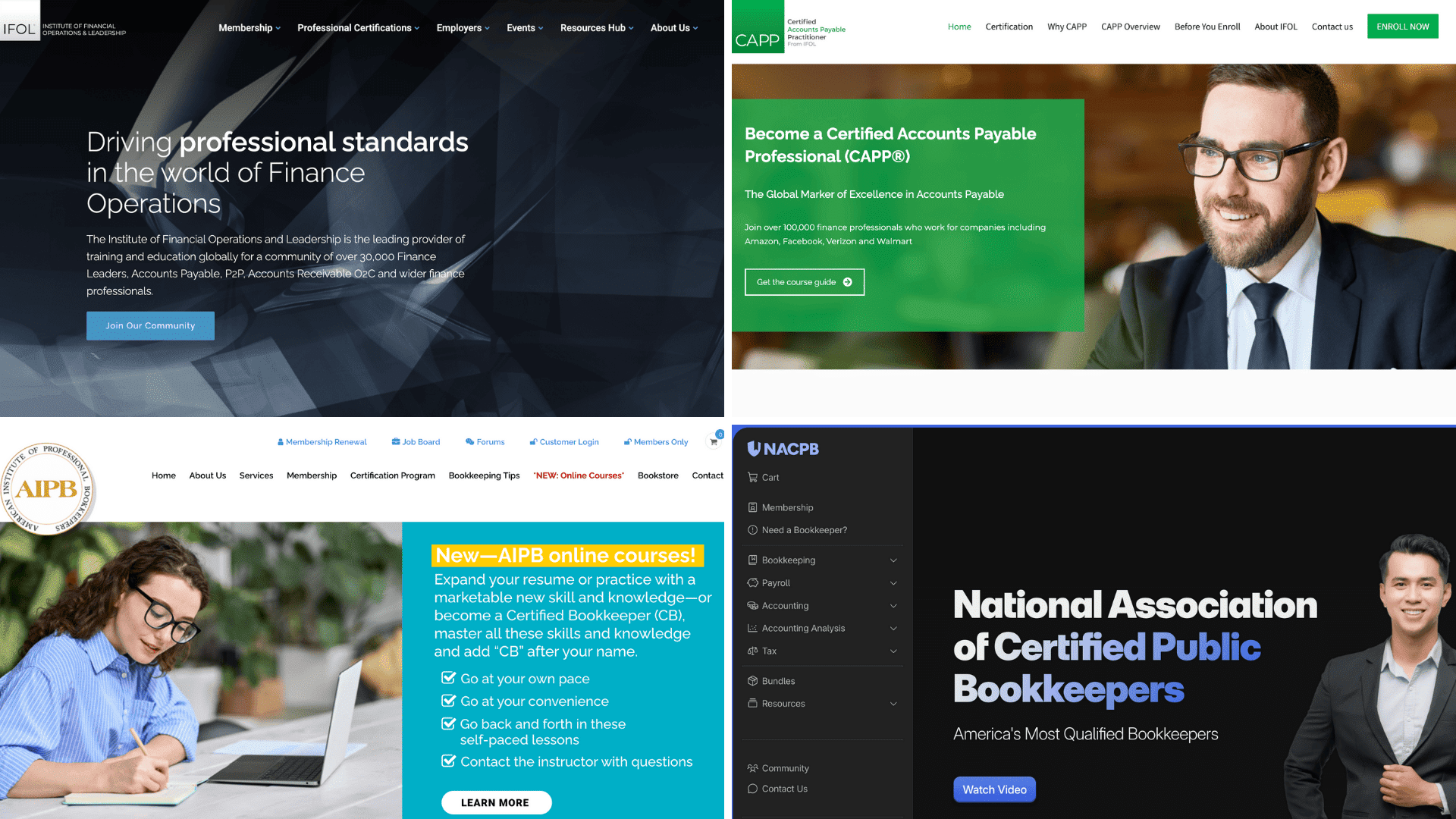

Top Accounts Payable Certification Providers (2025)

Professional certification providers offer credible, industry-recognized credentials that employers value.

These established organizations provide structured learning paths with comprehensive exams and continuing education requirements.

1. Institute of Financial Operations & Leadership (IFOL)

IFOL leads the industry with multiple certification levels designed for different career stages.

Their programs combine practical knowledge with strategic insights through online coursework and rigorous examinations that validate real-world AP expertise.

| CRITERIA | DETAILS |

|---|---|

| Best For | All career levels from entry to management |

| Format | Online coursework plus proctored exams |

| Duration | 2-4 months preparation time |

| Cost | $395-$695 per certification |

| Certifications | CAPP, CAPS, CAPM |

2. Institute of Financial Operations (IFO)

IFO offers the gold standard CAPP certification that requires proven experience and comprehensive knowledge.

This prestigious credential demonstrates mastery of AP processes and positions professionals for senior roles in finance departments.

| CRITERIA | DETAILS |

|---|---|

| Best For | Experienced AP professionals (2+ years) |

| Format | Self-study with comprehensive exam |

| Duration | 3-6 months of preparation recommended |

| Cost | $450-$600 including materials |

| Certifications | Certified Accounts Payable Professional |

3. Accounts Payable Certification (APC)

APC programs partner with industry leaders to deliver practical, relevant training.

These flexible certifications focus on current best practices and emerging technologies in accounts payable management and process optimization.

| CRITERIA | DETAILS |

|---|---|

| Best For | Mid-level professionals seeking specialization |

| Format | Online modules with industry partnerships |

| Duration | 1-3 months flexible timeline |

| Cost | $200-$400 depending on program |

| Certifications | Various AP specialist credentials |

4. American Institute of Professional Bookkeepers (AIPB)

AIPB provides comprehensive bookkeeping certification with strong accounts payable components.

This well-established credential covers foundational accounting principles alongside specialized AP processes, making it ideal for broader financial roles.

| CRITERIA | DETAILS |

|---|---|

| Best For | Bookkeepers expanding into AP specialization |

| Format | Self-paced study with proctored exam |

| Duration | 4-6 months of preparation is typical |

| Cost | $325-$450 total program cost |

| Certifications | Certified Public Bookkeeper with AP focus |

5. National Association of Certified Public Bookkeepers (NACPB)

NACPB offers specialized bookkeeping certification with dedicated AP modules tailored for U.S. market requirements.

Their practical approach emphasizes compliance, software proficiency, and real-world application of AP principles in various business environments.

| CRITERIA | DETAILS |

|---|---|

| Best For | U.S.-focused bookkeepers and AP specialists |

| Format | Online training with practical assessments |

| Duration | 2-4 months at your own pace |

| Cost | $297-$397 certification package |

| Certifications | Certified Public Bookkeeper (AP specialization) |

What Do These Programs Typically Cover?

Accounts payable certification programs provide comprehensive training across essential business functions. Here’s what you can expect to master during your certification journey.

- Invoice Processing & Approval Workflows: Learn efficient systems for receiving, reviewing, and routing invoices through proper approval channels.

- Fraud Prevention & Compliance: Master techniques to detect suspicious activity and ensure adherence to financial regulations and internal controls.

- AP Systems & Technologies: Gain proficiency in popular accounting software, automation tools, and emerging payment technologies.

- Vendor Relations & Payment Controls: Develop skills for managing supplier relationships, negotiating terms, and implementing secure payment processes.

- Leadership & Financial Operations: Advanced programs include team management, strategic planning, and cross-departmental collaboration skills for supervisory roles.

These core competencies prepare you for real-world challenges and position you as a valuable asset to any finance team.

Online vs. In-Person Learning Options

Both learning formats offer unique advantages for AP certification.

Your choice depends on your schedule, learning style, and career timeline.

Flexibility and Accessibility

Online programs let you study anywhere, anytime, without commuting. Perfect for working professionals balancing certification with jobs.

In-person programs offer face-to-face interaction and networking but require fixed schedules and geographic proximity to training centers.

Self-Paced Learning vs. Structured Cohorts

Self-paced online courses let you control the timeline, ideal for independent learners.

Structured cohorts provide accountability through scheduled classes and peer support, working well for those needing external motivation and collaborative learning environments.

How Long Does Certification Take & Cost Comparison?

Certification timeframes and costs vary significantly based on program depth and provider reputation.

Understanding these differences helps you choose the right investment for your career goals.

| PROGRAM TYPE | DURATION | COST RANGE | BEST FOR | ROI TIMELINE |

|---|---|---|---|---|

| Fast-Track Online | 1-4 weeks | $50-$200 | Quick skill validation | 3-6 months |

| Standard Certification | 2-6 months | $300-$600 | Career advancement | 6-12 months |

| Comprehensive Programs | 6-18 months | $700-$1,500 | Management roles | 12-24 months |

| Professional Credentials | 3-12 months | $400-$800 | Industry recognition | 6-18 months |

| Specialized Training | 1-3 months | $200-$500 | Niche expertise | 6-12 months |

Pro Tip: Certified AP professionals typically see 15-25% salary increases within the first year.

Choosing the Right Certification for Your Career Path

Selecting the perfect AP certification depends on your experience level, career goals, and industry requirements.

Consider these key factors to make the best investment in your professional future.

- Match Your Experience Level: Start with foundational certifications if you’re new, and advanced credentials for experienced professionals.

- Verify Industry Recognition: Choose established providers like IFOL or IFO that employers widely recognize and respect.

- Check Regional Relevance: Ensure certification meets local market demands and regulatory requirements in your area.

- Consider Continuing Education: Look for programs offering CPE credits to maintain other professional certifications.

Invest time researching employer preferences in your target roles before making your final decision.

Final Thoughts

Professional AP certification delivers concrete career benefits beyond basic training.

Certified professionals enjoy higher salaries, faster promotions, and access to senior roles requiring validated expertise. This investment quickly pays for itself through improved earning potential.

Start comparing certification providers today. Most organizations provide detailed curricula and enrollment support to guide your decision.

Choose your certification path now and begin building credentials that distinguish you in the competitive finance marketplace.